Come to the next 521 Pension Committee meeting

Wednesday, October 10, 6-8 p.m.

Location: SEIU 521 offices in Bakersfield, Fresno, Salinas, San Jose and Visalia via video conference

RSVP to Hoan.Pham@seiu521.org

State lawmakers reached a pension reform deal with Gov. Brown Aug. 28.

The governor’s original 12-point pension proposal included some heavy-handed reforms that were bad for working families, such as implementing a 401(k) style plan and forcing employees to work far too many years to reach retirement age.

The legislature’s pension proposal included revisions to the governor’s proposals.

Read the press release: SEIU California responds to Governor’s announcement of pension rollbacks

SEIU California issued a statement from Matt Nathanson, a public health nurse in Santa Cruz County and SEIU Local 521 Executive Board member, in response to the package of pension rollbacks announced today by Governor Jerry Brown.

Read more…

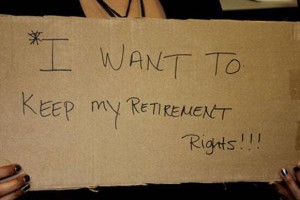

Make no mistake, working families take a big hit under the negotiated package of reforms. We all know Wall Street — not public pensions which workers pay into — is what crashed our economy. This was politics — and we made sure our political voices were heard this summer as deals were being made. SEIU 521 members were involved every step of the way: Lobbying legislators; testifying before the state’s pension reform committee; calling for smart pension reform that doesn’t leave working Californians in near-poverty upon retirement.

Main highlights from the deal:

Applies to all California state, local, school and other public employers, new public employees, and current employees as legally permissible.

Pension reform changes apply both to members of CalPERS and workers covered by County Employees’ Retirement Law of 1937 – commonly referred to as the “1937 Act” – except where exemptions are explicitly made.

1. Equal Sharing of Pension Costs: All Employees and Employers

New employees will be required to pay 50 percent of normal costs. Current employees will not immediately be required to pay 50 percent, but the employer can bargain to require current employees to pay any portion of the retirement contribution. There will be language allowing the employer to unilaterally implement an increased employee contribution, with certain limits, and this provision will take effect in five years.

This means that SEIU members will have a 5-year window to bargain the implementation of these shared costs.

The governor’s proposal called for current employees to start paying 50 percent of the costs immediately.

2. “Hybrid” Risk-Sharing Pension Plan: New Employees

The hybrid plan, which included a 401(k)-style plan, will be dropped, and instead a reduced formula will be implemented. Workers may retire at 52 under a reduced benefit formula, collecting 2 percent at 62 and 2.5 percent at 67.

The governor proposal called for new employees’ retirement plans to be a hybrid of pensions and risky 401(k)-style plans.

3. Increase Retirement Ages: New Employee

Implements a 2% at age 62 defined benefit component of the hybrid plan for all new non-safety employees and adjusts the retirement formulas to encourage members to retire at later ages. The earliest an employee would be eligible to retire is age 52 (increased from age 50) and the formula tops out at 2.5% at age 67 (increased from 63).

4. Require Three-Year Final Compensation to Stop Spiking: New Employees

We support real pension reform and oppose pension “spiking.” All new employees will fall under the three year final compensation rule as proposed by the Governor. Pension benefits for some public employees are still calculated based on a single year of “final compensation.” That one-year rule encourages games and gimmicks in the last year of employment that artificially increase the compensation used to determine pension benefits. The new plan will require that final compensation be defined, as it is now for new state employees, as the highest average annual compensation over a three-year period.

5. Pension Cap

The annual salary on which a worker’s pension can be based will be capped at $110,000 for those in Social Security and $130,000 for those not in Social Security.

Cities, counties, and other local jurisdictions will have the option of offering an additional benefit to those who make more than the cap. That option will not be available for state workers.

The governor’s proposal had called for implementing a 401(k)-style plan for new employees.

Also in the deal:

• Retirees can work a maximum 960 hours per year.

• Felons will lose their pensions.

• No more retroactive pension enhancements.

• No more “pension holidays” that allow employers and employees to skip contributions when pension funds are flush.

• Additional service credit purchases will be eliminated.