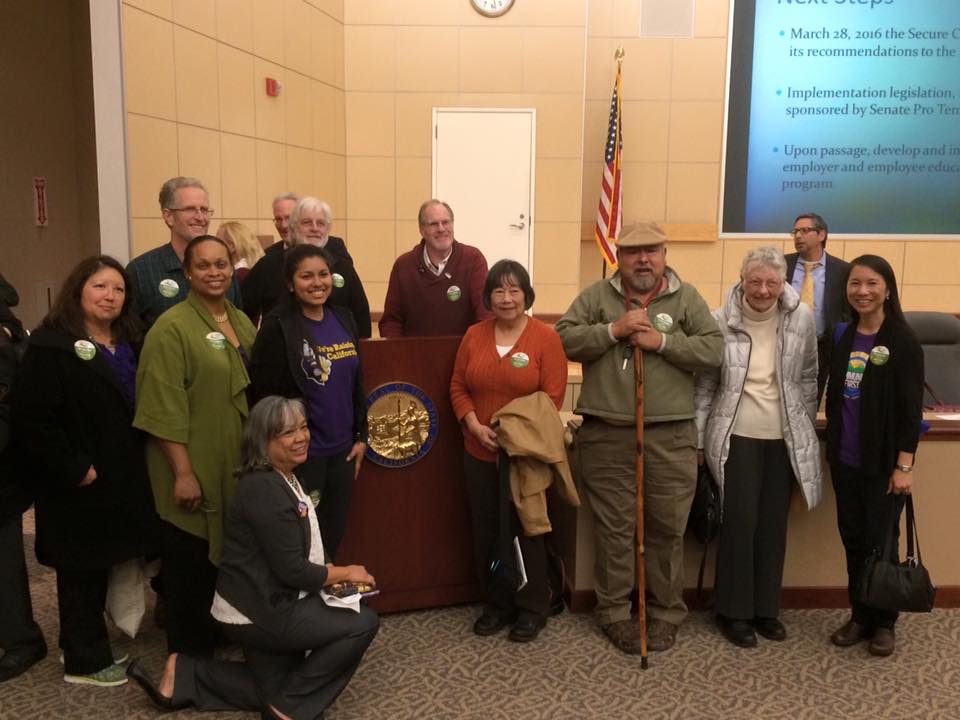

SEIU 521 members and allies advocate for the Workers’ Choice

SEIU 521 members, other SEIU union members, and allies urged the Secure Choice Board on March 3rd in Oakland to select the safest investment option for private-sector workers, the pooled IRA with a reserve fund, that will spread risk and be more stable and capable of paying monthly benefits consistently.

SEIU 521 members, other SEIU union members, and allies urged the Secure Choice Board on March 3rd in Oakland to select the safest investment option for private-sector workers, the pooled IRA with a reserve fund, that will spread risk and be more stable and capable of paying monthly benefits consistently.

Click here for more photos of the Secure Choice Public Hearing and here for photos of the press conference held just before.

“My work with homeless people in our county every day reminds me of how important retirement security is. One of the dramatic changes in the past few years is the increasing number of elderly people who are becoming homeless. As for the Board’s decision for where to invest the funds, I urge the board to choose the Pooled IRA approach with a reserve fund. People need a plan that will allow a predictable income stream. We are not looking to make it rich in the stock market by gambling with our retirement – we are looking for security and dignity for everyone in old age.”

– Matt Nathanson, SEIU 521 Retirement Security Chair

Since the corporate abandonment of pensions and Wall Street’s speculation and greed undermining 401(k) plans, American working people have been facing an uncertain retirement. Reversing the trend of attacking pensions and cutting Social Security, a board established by the state legislature and signed into law by Gov. Jerry Brown, is finalizing its recommendations for a new path towards retirement security for 6.8 millions of Californians who have little or none of it.

“I am 52 years old and I have being working in Fast Food Industry for 15 years. I have always worked 2-3 jobs to make ends meet. I support the Secure Choice because is important for every worker to have a retirement savings plan. I just finished sending my children to college and will now start to try to put some money on the side for retirement. The future really worries me since as I am getting older, I have less opportunities to be hired or won’t be getting enough hours. I urge the board to supports the safer pooled option with a reserve as I cannot afford to lose hard-earned money saved for retirement.”

“I am 52 years old and I have being working in Fast Food Industry for 15 years. I have always worked 2-3 jobs to make ends meet. I support the Secure Choice because is important for every worker to have a retirement savings plan. I just finished sending my children to college and will now start to try to put some money on the side for retirement. The future really worries me since as I am getting older, I have less opportunities to be hired or won’t be getting enough hours. I urge the board to supports the safer pooled option with a reserve as I cannot afford to lose hard-earned money saved for retirement.”

– Pablo Narvaez, Fast Food Worker

The California legislature passed SB 1234 in 2012, a law that created a board to study establishing the California Secure Choice Retirement Savings program, a plan meant to supplement Social Security. It will be designed for private-sector employees who don’t have access to any other employer-based retirement plan such as pension, 401(k) plan, etc. Employers with five or more employees would enroll them in the Secure Choice Savings program where they would contribute 3 or 5% of their post-tax pay into the savings plan. Employees could continue to contribute at that level, or increase their contributions, or opt out of the savings plan altogether. The plan would be portable so it could follow workers when they change jobs.

“What happens next for the Secure Choice program is going to directly impact me and our future generations in California. I want to retire with dignity and I want the Secure Choice program to be successful. We are the future and we need a safe retirement plan.”

“What happens next for the Secure Choice program is going to directly impact me and our future generations in California. I want to retire with dignity and I want the Secure Choice program to be successful. We are the future and we need a safe retirement plan.”

– Gloria Araiza, Children over Politics Youth Leader

Watch Gloria speaking here.

“I had planned to retire at 60, but because of my daughter’s dire financial situation, I continue to work to help my daughter and her children. I worry about her retirement. I want the best future for my family and for all working families. One way to insure that is to implement Secure Choice, and the pooled IRA with reserve fund is the very best option.”

– Rachel Grocha Welch, Santa Clara County Worker

There are powerful financial interests that oppose any attempt of working people acting together for their collective benefit. These institutions stand to make much more money administering individual savings accounts than a single pooled plan.

“I am a child’s first educator and I invested in children’s future by educating and nurturing them. But I feel that nobody cares about my future. I worry about my retirement every day, because as it is today, I live paycheck to paycheck. I’m here today to urge the Board to create a strong system that will allow private-sector workers like me to retire someday. I urge you to adopt a pooled IRA with a reserve, which will ensure a stable fund that provides the greatest return and the lowest risk for low-income families.”

“I am a child’s first educator and I invested in children’s future by educating and nurturing them. But I feel that nobody cares about my future. I worry about my retirement every day, because as it is today, I live paycheck to paycheck. I’m here today to urge the Board to create a strong system that will allow private-sector workers like me to retire someday. I urge you to adopt a pooled IRA with a reserve, which will ensure a stable fund that provides the greatest return and the lowest risk for low-income families.”

– Nancy Harvey, Child Care Provider

The Secure Choice Board is quickly approaching its deadline to submit its recommendation. At this point it has narrowed its options down to two.

1) The first is called a “Target Date Fund.” It would be individual IRA-type accounts whose investments would be divided between stocks and bonds in proportions determined by the participant’s age. Younger participants would have a larger share of their investments put into higher risk, higher potential return stocks and less in lower risk, lower return bonds. As the participant ages and approaches retirement, the proportions would gradually shift to a higher proportion of bonds versus stocks.

2) The second option is a “Pooled IRA with a Reserve Fund.” Here individual contributions would be pooled together – much like the Social Security fund – reducing volatility and creating the stability and capability to make consistent monthly payments. A 10% reserve fund would be created (using some of the first few years investments) to help smooth out any market losses and keep benefits being paid.

In both options the funds would be professionally administered, and costs for that would not exceed 1% of the participants’ contributions. There would be no costs to the state, taxpayers or employers.

The main difference between the two options is as much a philosophical approach as it is an economic one. Do we move together to ensure a stable, collective supplemental retirement benefit for all, or go with an individual approach that will create winners and losers depending on the vagaries of Wall Street?

“My husband is an Uber driver and we barely survive in the very costly Silicon Valley. We cannot travel and we do not have the requisite six months of pay in a nest egg somewhere, in case one of us faces catastrophic illness. Over the last 40 years, I worked very hard, holding different jobs in the retail, entertainment, non-profit and education fields. As the first one in my family to go to college, I put myself through college in my late 30’s with a student loan, working an array of part-time jobs which offered no retirement plan or health insurance. We need the pooled IRA with the reserve fund. Our money is too precious to put at risk.”

– Penny P., Santa Clara County Worker

Before the Board finalizes its recommendation to the legislature, it held two public hearings, one in Los Angeles on March 1st and another in Oakland on March 3rd, to hear from stakeholders – union workers, seniors and community groups, and people likely to enroll in the plan, as well as other retirement experts. We had a great turnout in Oakland with many testimonies.

“While I have a pension I can depend on, my aging children, in their fifties, are not eligible for a dependable pension like me. Each one of them started early and saved well for retirement but their plans were derailed by the recession. I feel that the personal experiences and hardship of my children are a good argument for the importance of pooled investment funds that at least tend to protect workers from larger market swings that they can’t predict. ”

– Dolores Manning, SEIU 521 Retiree from Santa Cruz

California is on the verge of making progress towards retirement security and SEIU members have driving it from the beginning. As union members, we are working to get one step closer to retirement security for all.

Secure Choice is a step in the right direction for private-sector employees who don’t currently have any retirement savings plan at work. We need to continue to work for Retirement Security for All and encourage you to join our next meeting on Wednesday, March 23, 6 p.m. Learn more here.

Did you know that most union-represented workers have retirement and health benefits, but other workers don’t? Not yet a full-member? Become a full-member today!

If you are already an SEIU 521 member, invest in COPE today and help us continue our fight to get retirement security for all.

SEIU Local 521 Participants:

Gloria Araiza, Children Over Politics Youth Leader from Visalia

Pablo Narvaez, Fast Food Worker

Nancy Harvey, Childcare Provider from Oakland

Connie Chew, Santa Clara County Worker

Penny Pruett, Santa Clara County Worker

Rachel Grocha-Welch, Santa Clara County Worker

Luisa Blue, SEIU 521 Chief Elected Officer

Matt Nathanson, SEIU 521 RSA Chair and Santa Cruz County Worker

Dolores Manning, Retiree from Santa Cruz County

Bob Sigala, Retiree from Santa Clara County Office of Education, Gilroy

Carmen Hanson, Retiree from San Jose

Harry Clark, Retiree from San Lorenzo Valley Unified School District

Carole Parkinson, Retiree from San Lorenzo Valley Unified School District

News Coverage:

“Union Leaders Call for New Retirement Plan to be Implemented,” Patch

“Union backs pooled IRA option for new state plan,” CalPensions